When I started this blog in 2005 I wasn’t exactly sure why I was doing it. I knew it was for me to learn about myself, but I think one of the big things I remember thinking at the time was it would be a vehicle for me to be able to look back in time and see how the day to day, month to month, and year to year gyrations of the stock market mean nothing in the grand scheme of things and how the people who promote the gyrations and the people who listen to and react to those short term gyrations are foolish.

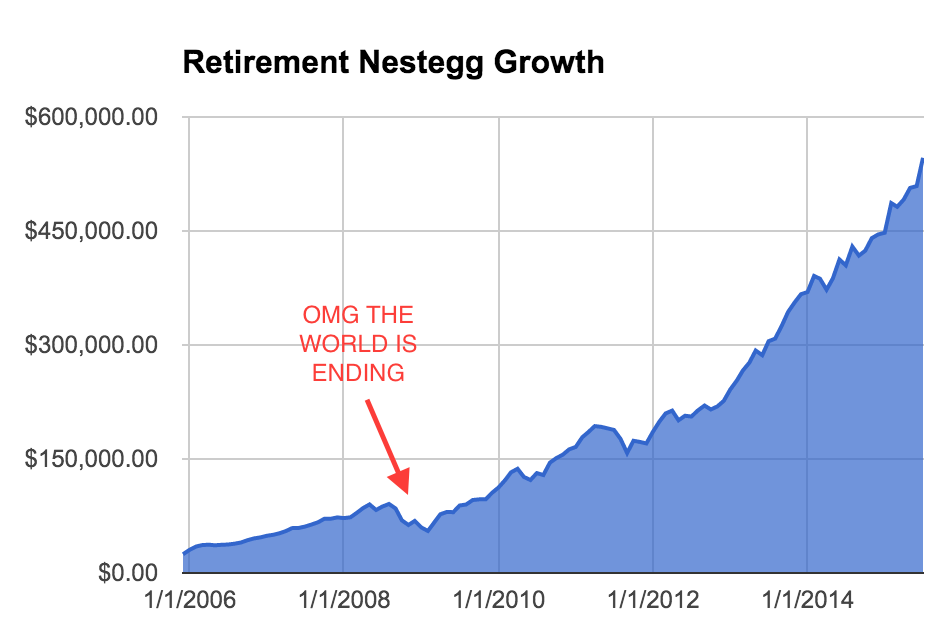

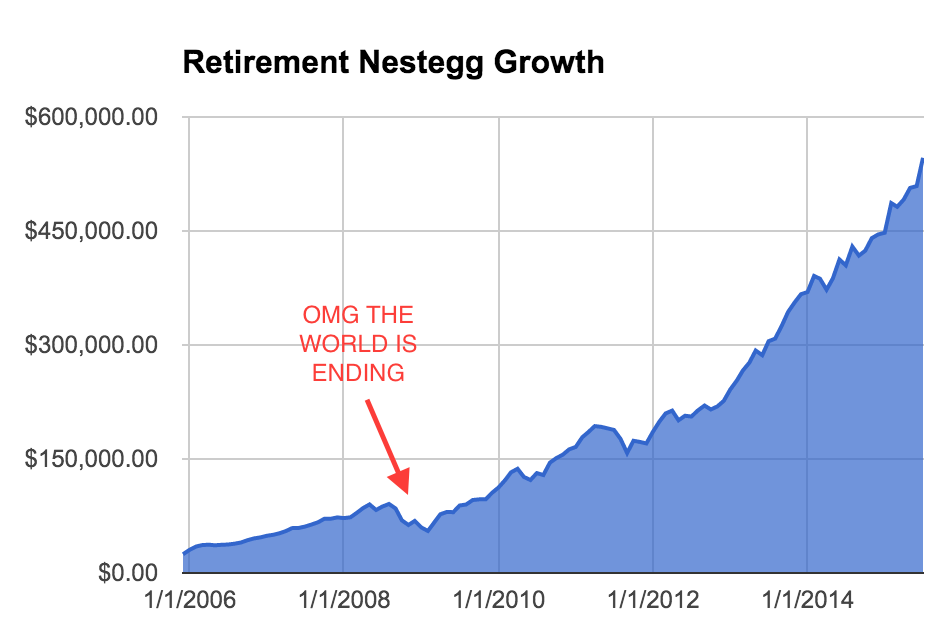

Well 10+ years of blogging and tracking my accounts have left me with a picture that I think the 26 year old MFJ thought he would see down the road.

It kind of blows my mind looking at that chart – especially the trajectory. That whole compounding thing is pretty powerful. The other thing that kind of blows my mind is that you have to almost squint to see the “Great Recession” where the economy and stock market imploded and if you listened to any of the news media the world was going to come to an end. Even some of the best Personal Finance bloggers out there at the time were losing their minds.

But just look at that picture – if you did anything other than plow your money into the market your entire lifetime you were throwing away boatloads of money.

Now granted I have slightly outperformed the market over the years, but here is a stat for you that I’m sure most people would argue can’t be true.

The SP500 during this tumultuous decade of lost wealth, stagnating economy, and just general doom has been up 12 of the last 13 years.

That’s right since 2003 the SP500 has only been down 1 time. That’s 92%!! The last decade plus has been an absolutely incredible time to invest in the stock market, but again I bet 92% of people you asked would have told you the stock market has lost money almost every year.

Even the last 13 years aren’t even that remarkable. Since I have been alive the SP500 has only been down 6 times. So 30 out of 36 years I’ve been alive – the SP500 has had positive returns.

The odds are definitely in your favor so if you haven’t already – get started, start investing, and create your own amazing chart of wealth awesomeness. All it takes is saving money, investing money, and time – then wait for the amazing things to happen.