This seems like kind of a horse after the cart type of moment, but I’ve more recently started to wonder what I am saving all of this money for. My retirement nestegg has grown exponentially and overall I think I have done a pretty decent job of saving a significant portion of my income for retirement.

I’ve set goals and have met them and I have toyed with setting new goals for myself. For example I set that $1M for 40 goal 2-3 years ago and never wrote a post as to what, why, or how I was going to do that. Part of the reason was that I didn’t know really the why and well the how part really relied on my investment returns which as we no tend to not be a linear/stable thing you can project over a short period of time like five years.

So take a step back – ever since I was in high school I knew that I wanted to live below my means and let compound interest work its magic. I am sure in high school I was leaning more towards the man if he let this money compound for 50+ years would have many millions of dollars at his disposal at 70 years old.

Then as I left college and began my working career and contemplated a family I knew that the idea of retiring early would definitely appeal to me. In fact my wife was going to school for teaching and shortly after graduation I was seriously considering going and getting a masters degree in teaching so that I could have summers off with my wife and our future family.

Then I realized teachers don’t make much dough so maybe it would be better for me to stay in a high paying field like computer science, get my MBA instead, save like crazy when I was young, and then when I was older and money didn’t matter that much maybe pursue that teaching thing as an early retirement.

In my MBA classes we had a class where you basically figure out what you want from life and what you want your career to be – in the end somehow I settled on college professor. Again I would have summers off, flexible schedule, and well the money was better than teaching high school, but then there is that whole PHD thing.

So while I never had a solid plan one recurring theme was having summers off with the family and saving money early on in my life to give me the freedom to pursue other options where the schedule was great and maybe the pay was not so great.

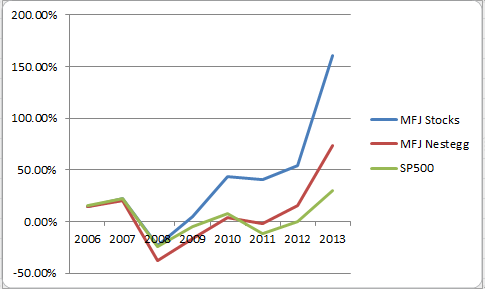

Well here I sit I am 34.5 years old and have accumulated 4 children that I have grown fond of. I have a retirement nestegg of nearly $370k, another $170k+ in cash savings, and a few other assets. I still have my mortgage $110k+ and some student loans of about $40k. So right now I have a liquid net worth of $400k+, though most of that is tied up in retirement plans that aren’t easily touched before age 59.5.

My career is going very good and I am able to save support my family of six while saving a significant amount of cash each year. I could have actually made probably a lot more money in my career, but have I shunned overtures by my bosses to take on higher roles or to relocate to Europe for the sole reason that I like my current work/life balance and if anything I would like to scale it back even further rather than go the other direction with more responsibility and more money. I have more money than I can use right now and the call of more money, a fancier title with more responsibility, advancing my career, or relocating to fancy places around the world does not appeal to me at all.

My wife has been able to stay home with our children and has graciously put off using that teaching degree until our kids are all in school. Ideally it would be awesome if when she decides to go teach full-time again that I was also able to convince my work to allow me to have a similar schedule if I took a proportional paycut. I am not sure if this will fly or not. I am well respected and valued and I do work for a European company where in Europe many of my colleagues have 6 or more weeks of vacation, but I do work in the USA and my boss even in my last performance review said he was disappointed that I was looking to keep a good work/life balance and not interested in taking on higher roles with my skill-set – so me turning around and asking to reduce my workload by 25-30% more might not go over well.

I could also take another step backwards in my career and go back to consulting and just work it out with a local consulting company that I don’t work during the summers – I think this may be more doable.

Regardless I need to be in an even better financial situation where I am not so dependent upon my primary job to provide for my family. This may require me to start saving more money in taxable accounts that are more easily accessible while I am younger than age 59.5

Conclusion

So if I had to cut this very long post down to a simple conclusion it is that I am saving money so that I have the freedom to spend more time with my family while they are young – especially during the summers. I want the flexibility and freedom from not having to pursue a job that does not fit this schedule.