My All Time Investment Performance January 2016

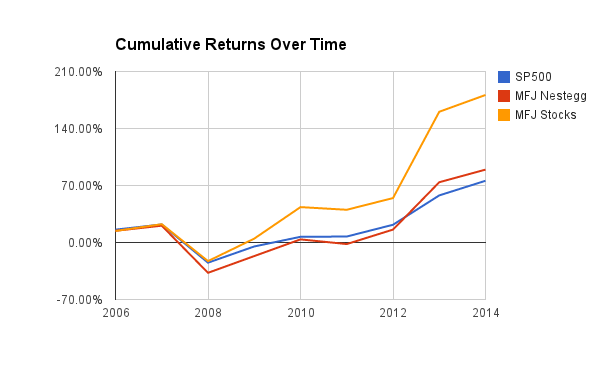

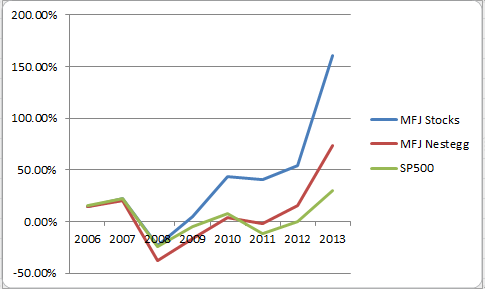

Continuing on my tradition from last year I have calculated my cumulative investment returns from 2006 until now against the SP500. I actually had to make some corrections to my calculation as I had missed the SP500 dividends in the annual return for some years so my outperformance was not quite as big as I had previously stated.

Overall my nestegg returns are still besting the SP500 though not quite as handedly as before. One item of note is my individual stock investments have crushed the SP500 over the years but my overall nestegg has just barely edged it out. This basically means I’ve underperformed the index with my 401k investments – which is kind of disappointing.

75% of my 401k today is in index/lifestyle funds, but in the past I’ve probably tried to be too smart and like most people cost myself returns versus just doing the smart/easy thing and sticking it all in an index fund. This is something for me to keep on an eye on.

On the other hand my stock performance has been so good it probably makes sense for me to just quit my job so I can cash out the quarter million dollars I have tied up in my 401k.

Returns By Year

| Year | SP500 | MFJ Nestegg | MFJ Stocks |

|---|---|---|---|

| 2006 | 15.79% | 14.37% | 14.20% |

| 2007 | 5.49% | 5.50% | 7.25% |

| 2008 | -38.42% | -47.98% | -37.00% |

| 2009 | 26.46% | 32.75% | 35.78% |

| 2010 | 12.48% | 24.60% | 36.94% |

| 2011 | 0.31% | -5.53% | -2.29% |

| 2012 | 13.47% | 18.12% | 10.25% |

| 2013 | 29.60% | 50.20% | 68.58% |

| 2014 | 11.39% | 8.91% | 7.91% |

| 2015 | -0.73% | 7.34 | 14.34 |

Cumulative Returns By Year

| Year | SP500 | MFJ Nestegg | MFJ Stocks |

|---|---|---|---|

| 2006 | 15.79% | 14.37% | 14.20% |

| 2007 | 22.15% | 20.66% | 22.48% |

| 2008 | -24.78% | -37.23% | -22.84% |

| 2009 | -4.88% | -16.68% | 4.77% |

| 2010 | 6.99% | 3.82% | 43.47% |

| 2011 | 7.32% | -1.92% | 40.19% |

| 2012 | 21.78% | 15.85% | 54.56% |

| 2013 | 57.83% | 74.01% | 160.55% |

| 2014 | 75.80% | 89.51% | 181.16% |

| 2015 | 74.52% | 103.42% | 221.48% |

Annualized Returns since 2006

SP500 +7.30%

MFJ Nestegg +7.36%

MFJ Stocks +12.39%