Retirement Nestegg Report – January 2014

Well I we started out 2014 with a down month for the market and to be honest that kind of excites me. Again I am young and am contributing so a bad market benefits me tremendously. Also as you can see I put over $9000 of new money into my accounts this month so have money to deploy should things start falling.

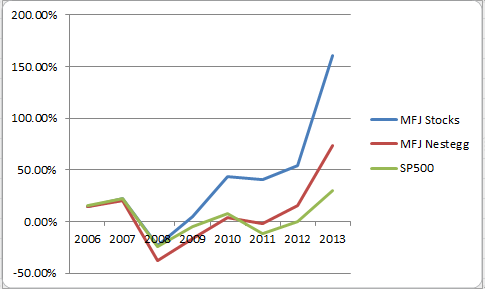

Once again I have bested the SP500 by a significant margin and while the time period is still short I am very excited at the prospect that I will be able to get market beating returns with my individual stocks and this will increase the already amazing power of compound interest. We will see – everyone feels like a genius during a bull market like we have had for the last 4-5 years, but overall things are going pretty well for me so far and its possible I have the right long term mindset to be able to beat the odds that so many investors face when trying to get above average returns.

Taxable Account – $5,218.22 (+83.73%)

Traditional Rollover IRA – $33,125.25 (+14.29%)

My Roth IRA – $104,502.73 (-1.34%)

Wife Roth IRA – $56,404.15 (+0.84%)

Traditional 401k – $170,426.51 (-1.58%)

Roth/Traditional % = 44.12% (tax free)

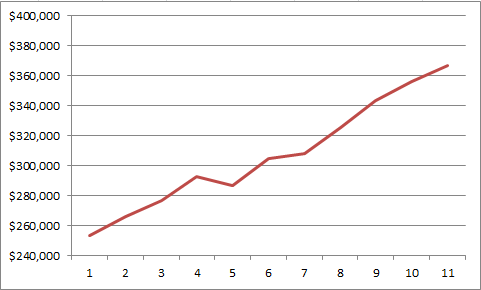

Total Retirement Nest Egg $369,676.86 (+0.77%)

Monthly Contributions $1,105.11 (401k) $2,500.00 (Taxable) $5,500.00 (Traditional IRA)

SPY Performance -3.56%

My Monthly Investment Performance -1.71% (+1.85% vs SP500)

My Monthly Individual Stocks Performance -1.26% (+2.30% vs SP500)