I lost $2 million dollars

Well every goal I set for myself on this blog I not only met, but in many cases vastly over achieved. As you can see from my last post I brought up that I made the comment in my 2018 report that

My goal some day is to lose $1 million dollars in portfolio value.

Well in January of this year I made a post letting everyone know that I had indeed accomplished that goal and now in the same year I’ve now managed to lose a second million dollars in portfolio value!

My portfolio had grown at absolutely insane rates the last couple of years and now it’s going the other direction having lost two million dollars over the last 12 months.

In some ways thats almost mind boggling as it took me 41 years to amass $2M and then just two years later I’ve lost more than $2M. This would be absolutely devastating for me if I hadn’t also hit $3M and $4M shortly after I hit $2M so basically where I sit now I am back to where I was 2 years ago. Easy come / Easy go and also where I was 2 years ago was absolutely incredible and mind boggling.

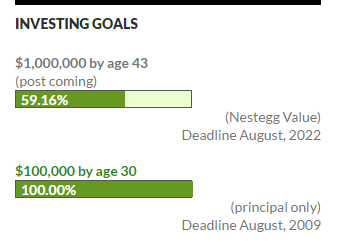

My absolute stretch goal for my nestegg set when I was just starting out was to hit $1M in nestegg value before I turned 40. Not only did I hit that goal 1.5 years early I was then able to run my portfolio well above $4M in the next 3-4 years. Compounding is powerful big numbers get bigger and the flip side can be said – big numbers drop bigly when the portfolio shrinks. It’s best to think in terms of percentages as dollar amounts can mess with your mind when numbers get big as those dollar amounts are mind boggling. The other thing to remember is the price to pay for those returns is risk & volatility. It cannot be avoided so it’s best not to get too high or too low. This is a long term game and the short term fluctuations don’t mean anything in the grand scheme of things. Draw downs like this will happen all of the time, and while it hurts to be down 50% from some arbitrary all time high, if I zoom out and look at where I have come from I am still incredibly proud of where I am.

I also know that with such a big draw down, the level of risk of further massive drops likely becomes less likely and there will be good days again in the future.

Now one thing I have learned from this draw down was that despite my constant insistence that being 100% invested in stocks all of the time is clearly the only smart play long term as it guarantees the largest long term gains and that volatility does not matter as long as you have a large enough margin of safety. Now I still logically believe this, I do think the idea of having a cushion of stable investments makes a little more sense to me now and I’ll try to explain why.

I have not ever touched any of my investments as I am young and do not rely on them to pay bills or make purchases. I am however constantly moving closer and closer to a day when I will likely start tapping into this huge pile of money for the freedom that it can provide. While I know I will have a large margin of safety built in when I do this, I do realize that the optimizer in me would have a hard time pulling money from the market when things have fallen so much as I know in the next couple of years todays prices will be extremely attractive and I would be dumb to sell. This is why I need to get better at building a large cash reserve when things are going extremely well. Yes I will cost myself somewhat in performance, but I will greatly increase the freedom buying power of that money. Meaning I can basically do whatever I want whenever I want with my money and whether the market is up a lot or down a lot will not affect those plans in any meaningful way.

To to this I’ve arbitrarily decided that I would need about 5 years of spending money with a good margin of safety and that in that case I would almost always be set regardless of what the market is doing or what my needs will be met and I would have cash on the sideline to take advantage of any major discounts. I am not sure if this goal should be a percentage or dollar amount as my spending would be a set dollar amount, but it probably makes sense to have a percentage of my portfolio. I think somewhere around 10-20% makes sense with maybe a cap on the dollar amount. Obviously it doesn’t make sense to raise cash now with the markets down, but as the market recovers and we get back to previous highs or close to it I think it makes senes for me once or twice a year look at my portfolio and raise some cash off of it – kind of like a self imposed dividend. This would give me my 5 years of cash that I would never touch and as the market continued to rise I could pull some additional off up to 20% and then when things fell I would have an additional margin of safety and could reinvest some of that money.

For those that knew TomE from the Motley Fool this is how he ran his portfolio. Like I said I was always invested and always in full growth mode, so I never saw the point and considered it at some level trying to time the market, but I now see the potential benefits for someone like myself. The additional financial gains really arnen’t that life altering at this point, but the loss of freedom of not having enough cash/safety and not wanting to touch depressed stocks to raise it is way worse than having a few less dollars total in the nestegg.