Ouch a very rough month for my retirement nestegg and for the 2nd month in a row my portfolio badly underperformed the SP500. To top it off I also finally made a land purchase so $131,000 came out of my savings account and went to buying some dirt. Also last month we purchased a new minivan for $15,000 so cash savings is flying out the door and my investment accounts are dropping as fast as they went up. Bottom line is I feel a lot poorer this month than I did last month.

In the grand scheme of things the investment fluctuations mean nothing. I have a pretty volatile stock portfolio and so when the market is up I usually greatly outperform it and when it is down well yeah I greatly under perform it. I guess the good news is the stock market is up a lot more than its down so in the long run this should benefit me.

Regarding the extra $150,000 in discretionary spending the last two months. Well yeah that part is probably not the most financially smart use of that money – clearly if I had put that money to work in my nestegg the last 5 or so years that I had been saving it I’d probably have a retirement nestegg in the 3/4 of a million dollar range. I also expect that the crazy spending will not end for a bit here as we actually build a house on the land and make use of the 15 acres of land that we purchased. However life is all about balance and while I may be “living it up” now I made dang sure that when I was in my 20s I put myself in a very good spot when it came to my financial situation and have even said that the foresight to take care of those things when I was young and get compound interest on my side early on will allow me to act like an idiot when I am older should I so choose and not screw up my retirement.

Now granted I could retire much earlier had I just set that as my sole goal, but again I am not dooming myself for the rest of my life I don’t think. While we likely will take on some debt with the new house – all of our purchases for the land, new van, etc were all done in cash and we still have a cash cushion of about $40k as well as about another $50-60k in equity in our existing house and we have no other debt other than our student loans so I am confident that even this wildly exorbitant spending regarding our new house will still allow us to pay off our mortgage, student loans, save for kids education and have a retirement nestegg well in 7 figures by the time we hit 50 (next 15 years).

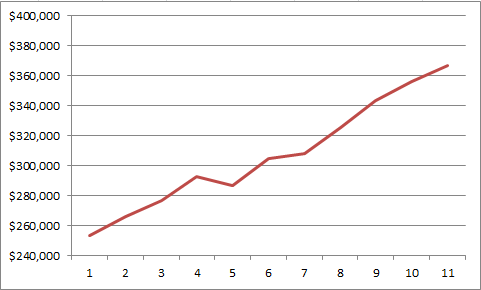

Anyway here is my monthly report

Taxable Account – $4,950.85 (-7.23%)

Traditional Rollover IRA – $30,879.84 (-6.10%)

My Roth IRA – $95,751.56 (-7.79%)

Wife Roth IRA – $53,893.27 (-6.38%)

Traditional 401k – $187,250.21 (-0.16%)

Roth/Traditional % = 44.59% (tax free)

Total Retirement Nest Egg $372,725.73 (-3.73%)

Monthly Contributions $753.77 (401k)

SPY Performance +0.62%

My Monthly Investment Performance -3.93% (-4.55% vs SP500)

My Monthly Individual Stocks Performance -7.08% (-7.70% vs SP500)