Dang time flies. It seems like just a couple years ago I was starting the blog and my career and I swear just last year I was writing my holy crap I’m 30 post.

Well the bad news is time flies and the good news is well nearly everything has gone exactly according to plan.

Here are things that I accomplished in my 30s

- Had two more children to bring the total to 5

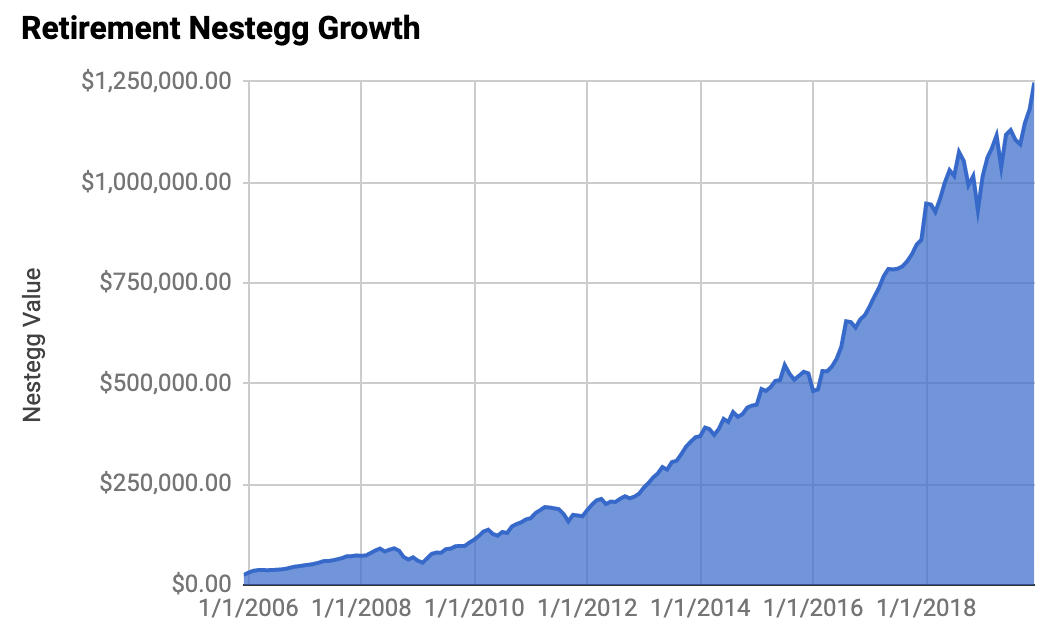

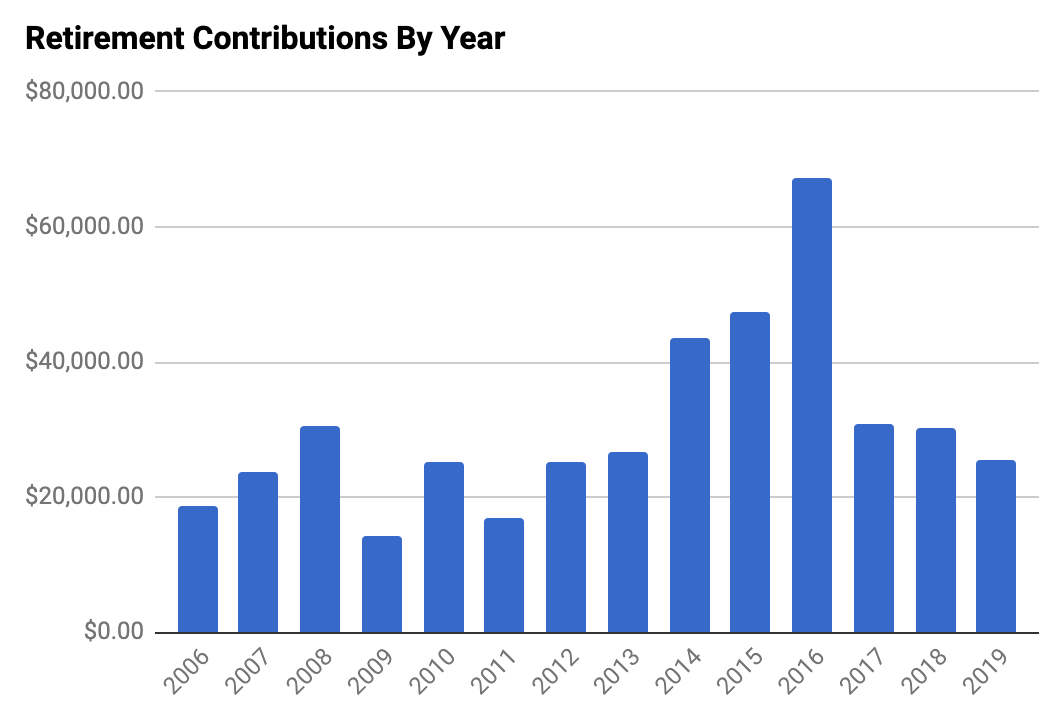

- Added over $345,000 in contributions to our nestegg

- Grew our retirement nestegg by over $1 million dollars

- Able to have my wife stay home with our children

- Remained debt free other than mortgage and student loans at very low rates

- Built our dream house with basketball court

- Resisted the Tesla urge and still driving a crappy car

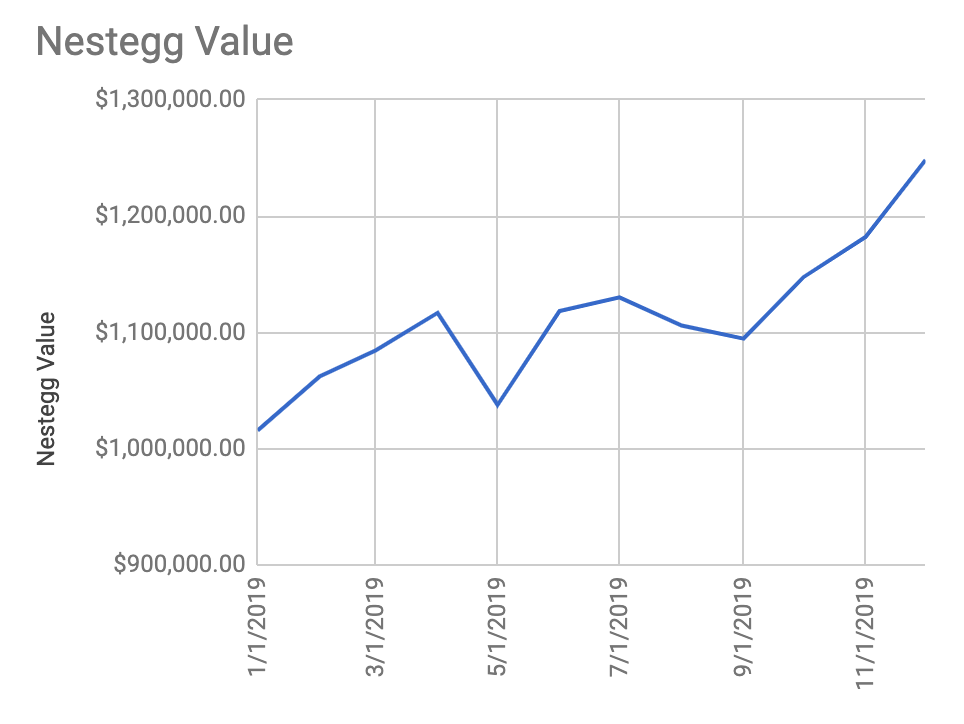

- Achieved a 7 figure retirement nestegg at age 38

- Started partial early retirement at age 39 (summers off)

Obviously the huge amount of contributions we made in our 20s and 30s got us to where we are today. Ultimately though living well below our means allowed us to do this basically on 1 income for the vast majority of our 20s and 30s while supporting 5 kids and to be perfectly honest it wasn’t all that difficult.

Simply prioritizing things in our life that lined up with our values made things just fall in place without really ever feeling like we were sacrificing something for the future. We went through two decades of life probably spending less on all of our vehicles combined than a lot of people do on one new vehicle.

We probably spent less on eating out and drinking in those two decades than most people do in one year. Probably same with clothes or a host of other material examples.

We did spend money on things we knew we would enjoy like family vacations, but even there our lifestyle allowed us to enjoy those vacations at a lower cost and I’d argue an increased enjoyment than the average family.

Ultimately the thing that I am most proud of was hitting that partial early retirement goal this year at age 39 as that was the whole point of everything since this blog was started. That idea even predates the blog in that I always knew that I would want work to take a back burner to spending time with family.

I now have an arrangement where I don’t need to work in the summer going forward and my wife’s job also allows her to be off in the summer so we have a maximum amount of time to spend when our kids are off school. The best part about this is the retirement nestegg giving us the freedom that if for whatever reason this arrangement with the employer went away we could just find another arrangement that worked without fear of affecting our finances or our future or our kids future. This freedom is what this financial journey is all about and as time goes on that freedom will continue to expand.

Financial Mistakes I have made or areas where I’ve fallen short

- Sitting on too much cash

- Putting my health on the backburner

- Likely spending too much money on our house

- Don’t have a will

Honestly I made some mistakes in hindsight. I was overly conservative with my cash holdings where if I had more of that money invested I would clearly be more wealthy than I am now. Probably not the worst flaw to have in that I have too much money saved on the sidelines in emergency funds.

We did spend a lot of money on our dream house and have continued to throw lots of money at it. If we had not splurged here I’d have many millions of dollars no questions asked, but my quality of life probably not affected too much other than I would have likely started early retirement a few years earlier.

Now the two areas that I would for sure have changed. We have 5 kids and a large net worth and have no will. This is probably pretty stupid especially if my wife and I die.

Probably the biggest thing I’d change is probably not directly a financial item, but a health one. I’ve worked a desk job my entire life and while I was athletic most of my life and generally ate healthier than most people I basically got to my late 30s as a broken down old man. I had serious back issues and basically had 18 months where it was difficult for me to even play with my kids. All of this was self induced by sitting on my butt for 20 years and gradually removing all forms of exercise from my life as I was chasing my 5 kids around.

I recently rectified this in the last year and even built a weight room in my basement. I feel 15 years younger and honestly probably consider this a bigger accomplishment than anything I have done for myself financially. Combining them both leads to a pretty happy low stress life.

In my holy crap I’m 30 post I wrote

In general I think by the time I hit 40 things should really be in cruise control. I hope to have most of my house paid off and a very nice cushion in my retirement accounts. When I hit 40 my oldest kid will be 14 years old and I hope that at this point in time since money will be less of a concern that I can become a free lance consultant, become a teacher, or do something that will afford me considerable free time where I can enjoy summers off and vacations with my family.

–30 year old MFJ

That was the rough idea a decade ago and for the most part I think things came together exactly as planned. I spent this entire summer with my kids. Took them on a trip to Europe and can confirm that money is less of a concern for our family at this point where we can concentrate on things that matter without money being the primary deciding factor.

As I look forward to my 40s I would expect that my wife and I will continue to trade less work for less money. Time and freedom will be more important than the size of our paycheck. I hope we will use this next decade to truly enjoy our kids as a few of them will leave the house this decade. From a financial standpoint I expect our nestegg to continue to do all of the heavy lifting and the only wild card out there will be helping 5 kids attend college. I expect at some point one of us will look into starting a business in something we are passionate about and if things go really well I could see both of us retiring fully before we hit 50.

Regardless of what the future holds I know that we have set ourselves up for a great future and I really look forward to time slowing down and being able to enjoy life to the fullest

–40 year old MFJ