Whoops I saved another $100,000 and didn’t even try

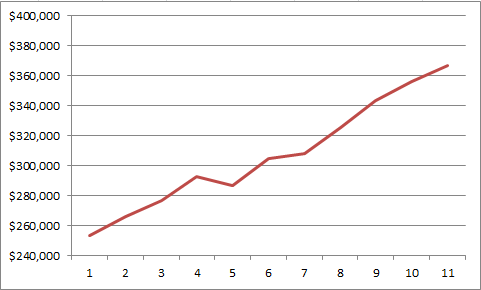

Probably one of the more popular things I’ve done on this blog was set the goal of having saved $100,000 in retirement accounts by the time I hit 30. I ended up falling just short of that goal, but overall it was a great exercise.

Since then I have really been in cruise control (probably not a great thing) and I thought I had been doing a horrible job saving for retirement as I was saving fairly aggressively for a new house – in fact that was the reason I fell short of my original goal to save $100k by age 30.

Last January I had mentioned that I had enough money in our house savings that I could pay off our mortgage entirely. A year later and my house savings has grown by over an additional $50,000. It honestly makes me sick knowing that I have that much money sitting there doing nothing for me, but given what we think we want in regards to a large chunk of land out in the country I thought it was necessary.

So here I sit I have over $175k in cash waiting to get lit on fire for a house/land purchase and I feel like the biggest bozo in the world knowing that this money could be used and should have been used to get me very much on my way to becoming financially independent and I was doing the bare minimum when it came to my retirement savings.

I decided to do the math since I completed my original $100,000 by age 30 goal less than 4.5 years ago and it turns out since then I have saved $101,691.90 or about $22,500 per year. While it’s not that impressive by itself is pretty good when combined with the amount of money we also were simultaneously saving for the new house and land.

Since I started this blog at the end of 2004 – I have saved roughly $377,000. That works out to about just under $42,000 per year.

I do not micro-manage my finances as I don’t feel the effort is worth it. I know my wife and I share a similar mindset so it doesn’t take any kind of special effort or sacrificing on our part to control our spending where as a result of our relatively modest income and supporting our 4 children we are still able to save a decent chunk of change.

So what’s next – well the reason I actually went through this exercise was to kick myself in the butt about being such a slacker when it came to saving for retirement. I also have been doing some considerable thinking with regards to what I am trying to accomplish financially here.

I set some great short term goals for myself, but the last few years I have been flying aimlessly in the wind when it came to what I was trying to accomplish next. I have some ideas as to what I want to accomplish and think I have started to piece together some visions I had for myself going all the way back to college, but wasn’t sure how I would accomplish them. I think I now know how I can do this and this excites me.

So look forward to some posts in the near future and a renewed sense of excitement as I set some new goals for myself here.