Traditional Rollover IRA $10,782.36

My Roth IRA $31,604.25

Wife Roth IRA $17,183.87

Current Traditional 401k $40,916.17

Total Retirement Nest Egg $100,486.65

Well as you can see from above nestegg report I broke through the 6 figure mark for the first time in my life. What does this mean in the grand scheme of things – pretty much nothing, but it is a fun milestone to know that the value of my retirement nestegg reached $100,000 shortly after I turned 30.

On the flip side another milestone that I reached a little late is I now have contributed over $100,000 to my retirement accounts in fact $100,357.96 to be exact. So as you can see I am a horrible investor. After 5 years of living below my means, and consistently contributing a large percentage of my income to my retirement accounts on a regular basis I have amassed $128.69 in investment gains or 0.13% return over 5 years which annualized is even uglier. Far cry from the 10% that most people including myself use for rough planning on how much they will have for retirement huh?

Well there’s more to the story that makes me look slightly better. Over the same period of time the S&P 500 has returned a -2.0%. So while its not exactly apples to apples I am actually slightly beating the market over this year period of time. Woohoo!!

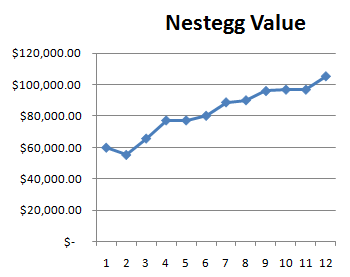

Another very interesting comparison is that the DOW just passed 10,000 for the first time in a year and is at a 52 week high. If I go back exactly 1 year ago – my retirement nestegg was $69,300. So while the DOW has returned 0% over the last 12 months – my retirement nestegg has grown by 44.8%. Even if I take out extra contributions I made during this time I still have a 33.44% market return – which crushes the market return.

Why is this? Is it because all of a sudden I turned into an investing genius? Yes and No. The biggest reason for my market beating returns in the last year was because I did not get freaked out when the market was crashing and everyone was predicting the end of the world. I did not pull my money out of the stock market and I did not stop contributing new money – I did the opposite.

In fact going back and reading my posts from a year ago I did a pretty good job of keeping a level head and taking advantage of the depressed stock prices and kept my purchasing during the huge downturn right on schedule – in fact in many cases I tried to amp it up the best I could and now am reaping the rewards. The simple mantra of Buy Low is not nearly as simple in practice as it sounds, because when things are low everyone blows things out of proportion and tells you the world is going to end and any money invested in stocks will vaporize in a short period of time. Ignoring all of those voices and trusting yourself is not an easy task, but luckily I did ok in my first test as investor and things have turned out ok.

So in the grand scheme of things what does $100,000 mean? Actually pretty much nothing other than I am heading in the general right direction – which is pretty much all you want to do with most long term efforts. Do a number of a little things right and they starting adding up to bigger and bigger accomplishments.

Now I tried this once before and it worked so I figure I would give it a try again. Personally $100,000 is great – it makes me feel good – I can pop an expensive bottle of water and celebrate my conquest of reaching $100,000, but in the grand scheme of things I would much rather see my retirement nestegg fall back down to $50,000 than go up to $150,000 at this point in my life if it means the market is going to tank again as I’m still very young (that’s what old people say each time they reach the next decade of age) and in the long-term I’d be much better off while I am still a net purchaser of investments to have those investment prices depressed.

That being said I look forward to the day my retirement nestegg grows to $200,000, $500,000, and $1,000,000, and beyond.