Well the end to another exciting year for my retirement nestegg. I don’t listen very often, but whenever I do turn on a tv or a radio I hear about how horrible the economy is and how bad the stock market is doing and how investors are so nervous and many of them are not putting money into the stock market because of the horrible returns and as I listen I think to myself are these people nuts?!?

This year the SP500 returned 12.84% and last year it returned 26.46% and thats just the average of the large companies in the stock market. Many other areas are doing even better (Russell small cap index has returned 31% and 25% the last two years). My retirement nestegg grew by 54.34% and most of that was due strictly to investment gains.

Now certainly this can’t and won’t go on forever, but it just shows that all of those people who told you to take all of your money out of the stock market when things were ugly in 2008 were basically telling you to destroy any chance you had at gaining a respectable return on your investment. Sell low and stay out of the market and wait to get back into the market until after all of the gains have been made back. Absolustely horrible investment advice but you hear it absolutely everywhere.

Warrent Buffett is famous for saying

Be fearful when other people are greedy and greedy when other people are fearful

which is great advice if you are actually trying to time the market, but my advice would be to consistently and regularly invest in the market regardless of whatever is going on and do your absolute best to ignore any advice anyone is trying to give you with regard to short term market fluctuations (anything less than 5-10 years)

I do find it funny though as I looked back at last year’s year end summary and how completely laid back and nonchalant I was about my retirement plan and my investments. I was probably overselling it in that post but I really am completely in cruise control and planning for and saving for my retirement really does take so little effort on my part now days that I really could disappear for a year or two at a time and things would keep on chugging along without me.

Where I turned out to be a little off base from where I stand today is when it comes to individual investments (namely stocks). I made this quote

“From now on I will check my investments maybe once or twice a year and then pretty much forget about them and live my life – which in the end is the whole purpose of this investing game.”

While that still can be very much true and I don’t spend a lot of time on my individual stocks (I can go 6 months or more without checking up on an individual stock) I do spend a couple hours a month looking at my stocks and looking for new stocks and do really actually enjoy it. What really perked my interest early on this year is I took the time to go back and calculate my individual stock picks performance vs the market to see if it was worth my while and turns out I have been actually really good/lucky at picking winning stocks thus far in my investing career and made me realize those extra couple hours are really worth the effort.

My individual stocks beat the SP500 24.1% this year, 9.32% last year, 1.42% in 2008, and 1.76% in 2007. The only year I didn’t beat the market was in 2006 and that was really my first year investing and I made some really bad decisions – yet still only lost out by 1.59%. Does this mean I am an investing genious – probably not but it does give me some confidence to keep roughly half of my retirement nestegg in individual stocks (ironically it should be much lower than that as I haven’t contributed to my individual stock accounts in over two years due to us saving for a house but it is growing at such a fast pace that it keeps ahead of the 401k account where I contribute money every paycheck).

Anyway this was a really great year for my retirement nestegg as it grew by 54% and my individual stock performance just crushed the market (thank you Netflix and Chipotle Mexican Grill)

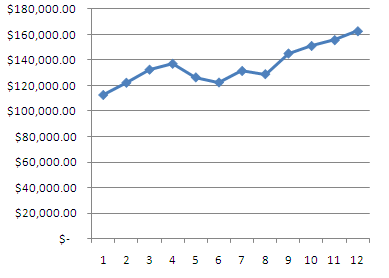

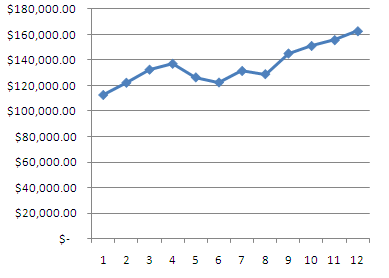

Anyway here is my year December year end report.

Traditional Rollover IRA – $12,763.45 (+2.53%)

My Roth IRA – $44,872.34 (+2.09%)

Wife Roth IRA – $26,105.90 (+5.16%)

Current Traditional 401k – $78,953.21 (+6.00%)

Roth/Traditional % = 43.62 % (tax free)

Total Retirement Nest Egg $162,694.90 (+4.49% 1 month) (+54.34% 1 year)

Monthly Contributions $605.84 (401k)

SPY Performance +6.13%

My Monthly Investment Performance +4.10% (-2.03%)

My Monthly Individual Stocks Performance +3.10% (-3.03%)

My Contributions for 2010 $25,152.01

SPY Performance for 2010 +12.84%

Investment Performance for 2010 +24.60% (+11.76%) ** see below

Individual Stock Performance for 2010 +36.94% (+24.10%)

Total Investment Return +$32,127.00

** This figure is not exact because I don’t want to do the math to figure out returns from each and every paycheck contribution so I took the entire YTD contribution of $25k and added it to the total of the previous years nestegg – effectively making it seem like I made all of my contributions Jan 1 – when in fact they were made throughout the entire year which greatly lowers my investment return – if I moved them to the end my return would have been 42% which obviously is overstated so I played it safe and took worst case scenario – even under worst case scenario I beat the market handily in my 401k.