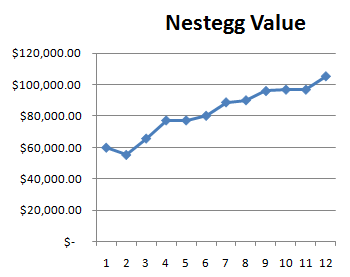

Retirement Nestegg Report – June 2010

Well things are headed down again and I have to admit I am sort of hooked back into the market and have been doing a lot of research on possible investments again. Funny if you read my posts from the turn of the year I had pretty much said I was in cruise control and would only be looking at my investments a couple times a year. Well that certainly hasn’t been the case and I have been doing a lot more research and been buying a few new stocks as of late.

Part of my excitement may have been due to the fact that the market is headed south again and also because I went back and calculated my individual stock performance since I started investing (previously I had lumped it in with my 401k/mutual funds) and found out that my individual stocks purchases are consistently beating the market and my mutual fund purchases and have been the last 4 years. You can now see this additional line item “Individual Stock Performance” and my performance vs the SP500 at the end of each Nestegg Report.

Here is my individual stock performance for 2006-2010 YTD vs the SP500

2006 -1.59%

2007 +1.76%

2008 +1.42%

2009 +9.32%

2010 YTD +6.13%

The only year I have trailed the SP500 was my first year and I sure picked some horrible stocks with my first couple purchases. Since then I have been doing pretty well. I guess this justifies some of the time I spend researching individual stocks.

Here is my monthly nestegg report.

Traditional Rollover IRA – $10,792.32 (-2.27%)

My Roth IRA – $33,229.84 (-2.72%)

Wife Roth IRA – $18,681.44 (-7.15%)

Current Traditional 401k – $59,670.70 (-2.29%)

Roth/Traditional % = 42.42 % (tax free)

Total Retirement Nest Egg $122,374.30 (-3.18%)

Monthly Contributions $908.76 (401k)

SPY Performance -5.15%

My Monthly Investment Performance -3.90 % (+1.25%)

My Monthly Individual Stocks Performance -4.52 % (+0.63%)