Well it seems like just yesterday I was in high school math class learning about exponentiation when a light bulb went off on my head about the power of saving money with compound interest on your side and now I’m 30 – holy crap time flies.

Since this is a pretty historic milestone in my personal finance journey as well as my life in general I thought it would be a good time to sit back and look at the good and bad from the last decade. Some of the items I list may or may not be entirely financial at first glance, but I’m certain they have all affected where I stand financially today.

Things I accomplished financially in my 20s

- Earned my Bachelor’s degree in Computer Science

- Got Married

- Had three children

- Bought a house (not sure that’s an accomplishment given the times I bought it in and well my position on the financial benefits of a house)

- Earned my Masters Degree in Business

- Started 401k, Roth IRA, 529 College savings fund (STARTING is the most important thing)

- Own two vehicles without any auto loans

- Never carried a balance on a credit card in my life

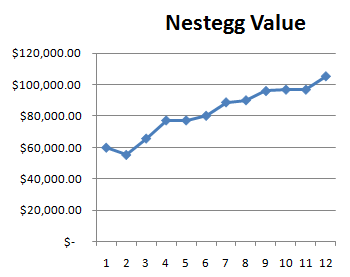

- Basically attained my $100,000 by Age 30 retirement nestegg goal

- Able to have my wife stay at home and raise our children

- Saved up $35k for our dream house fund

- Never had an argument with my spouse about money problems (I’m the luckiest guy in the world here where my wife and I see eye to eye when it comes to money)

- Never had to worry about how to pay the bills (I get extremely nervous when our checking account falls below $2,000)

- Created this blog

Overall from the positives I really was lucky enough to “get it” financially at a young age and then be lucky enough to get married to a person who thinks and acts the exact same way as me. Now don’t get me wrong we aren’t a pair of tightwads who don’t know how to have fun or enjoy life – its just that we both know whats truly important in life and what will truly make us happy. We don’t need to drop $30,000 on a new car to realize after the fact that owning something new and shiny is not going to make us truly happy.

For us the peace of mind of knowing that by forgoing so called pleasures now will give us the security and freedom to do what we want with our lives and not be worried about trying to pay down debt or being stressed out wondering where the money will come to pay the bills. Money doesn’t control our lives in fact I think its just the opposite – we control our money and are able to live our lives the way we want it – instead of so many people who have it backwards and don’t bother to learn how to manage their money because they don’t care or don’t want to deal with money when deciding what to do or what to purchase and then it ends up running them the rest of their lives.

Overall though I’d say from the list other than marrying an awesome wife – would be my degrees as they are the drivers of my income – amazing how a little work to get a few degrees early on in your life can change the trajectory of your income for the rest of your life. Quite possibly the best investment you can make. Obviously staying clear of bad debt and managing our money is good too, but I’d probably have to put starting this blog very high up on the list. This blog has been invaluable to me to get me thinking about my finances, setting goals for myself and writing them down (amazing how powerful this is), and then being able to constantly be able to come back to my thoughts and plans on this blog really has been a tremendous benefit. I’m sure everyone at some point in time starts planning out their lives or what they want to accomplish, but so many people don’t write it down somewhere and then after a few months/years those plans/thoughts are completely lost. The added benefit of doing it in a blog format is you can get incredibly insightful feedback from people who are kind enough to provide comments or emails on your content (this being a prime example).

Overall I am very happy where we stand today, but as you can see from the list below it wasn’t all easy and mistake free and I wasn’t exactly a model example in my 20s.

Financial Mistakes I have made or areas where I’ve fallen short

- Buying individual stocks on a whim when first starting out

- Investing $1700 of “dream house” money into individual stock

- Purchasing a whole life insurance policy

- Philanthropy

- Don’t have a will

Certainly the two stock related items on the list I probably knew better before hand, but can chalk it up to experience. When I first started out I had no clue what I was doing and like 99% of people should have invested in low cost index funds from vanguard and left it at that. I invested all the money at once in 4 individual stocks that I knew nothing about and looking back now lost a fair amount of money – in fact one of those stocks is now bankrupt. Before I bought those stocks I actually got talked into buying a whole life insurance policy and a rather large one at that. I understood compounding and didn’t understand the stock market at all so this was an easy way for me to get started “investing”. The more I read up and learned the more I realized what a horrible “investment” whole life insurance was and eventually cashed out for a term life insurance policy that I purchased over the internet and invested the rest.

Another area where I feel I have fallen short of so far is Philanthropy. My wife and I give to our churches, we pitch in on special items such as donations to Heifer International, family members running marathons for LLS, I volunteer at church and am a member of a Lions Club, but I feel that we could do a lot more with the amount of money that we give to charity and the regularity that we give to charity. We get better each year, but in the end I’d like to see us get at least to 10% of our income in cash donations. I have no idea where we stand on this right now, but I know its probably less than 5%.

A will – I have brought this up a couple times on this blog, have a family member who works for a law firm and can get us a family discount, have over $1M in life insurance, 3 kids, and still have no will. No excuse and this is something we need to do this year.

Things I have not accomplished but should in the next decade

- Create will (this year darn it)

- Build house

- Find job that gives me even more time to spend with family and travel during summer

I have an entire other post that I am working up with goals for myself before I reach age 40, but in general I see the next decade as my major earning years and at the end of the next decade I really hope to be in good shape. About the only stupid thing I plan on doing in the next decade is to build a house. Other than that I hope to continue my retirement savings and build up a nice nestegg heading into my 40s.

I have not calculated out my nestegg values going forward in quite a while but I know a few years back when I did I expected to hit $1 million dollars in retirement accounts by about age 42. This was very dependent upon getting good returns in the stock market, but in general I think by the time I hit 40 things should really be in cruise control. I hope to have most of my house paid off and a very nice cushion in my retirement accounts. When I hit 40 my oldest kid will be 14 years old and I hope that at this point in time since money will be less of a concern that I can become a free lance consultant, become a teacher, or do something that will afford me considerable free time where I can enjoy summers off and vacations with my family. Again look for a post on my XX by Age 40 goals.

In conclusion I feel like I made a number of positive steps in my 30s, I made mistakes that I can learn from, and hopefully in 10 years when I am writing up my “Holy crap I’m 40 – my 30s financial review” I will feel as good about the next 10 years as I did the last 10.