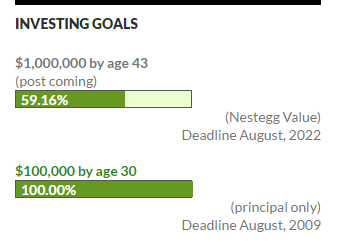

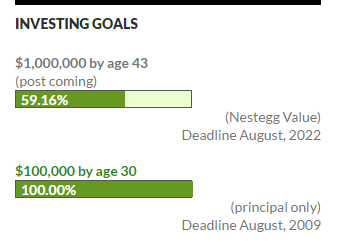

I’m sure I’m not unique and I’m sure every financially savvy person has contemplated the day when their net worth / account balance will surpass the magical $1,000,000 mark. When I started this blog in 2005 I put together a goal of having saved $100,000 in money for retirement by age 30, because as we all know saving the money while you are young allows compound interest to kick some butt on your behalf.

Well in August 2009 the deadline for my $100,000 by Age 30 goal came and while I fell just short I had put myself in a great shape financially going forward. I immediately did the smart thing and laid out the next goal $1,000,000 by age 43 and even put a nice little tracker on my blog with the (post coming) and then proceeded to never sit down and write the post

Even before I started this blog at age 26 I had created excel spreadsheets forecasting my savings into the future and estimated returns and always seemed to come up with age 42 or 43 as to when I would cross the 1 million dollar mark. In my heart I always wanted to hit it by 40, but I never seemed to get the math to work with my then 21 year old brain which if you know a 21 year old probably wasn’t all that sharp.

Ironically when I created my little tracker for when I would hit $1M I relied on the calculations I had done even before I got my first job instead of doing the simple math and probably realizing with a little hard work $1M by 40 was probably attainable. So I probably set the bar too low and then I compounded that mistake by not putting together any meaningful plan as to how to achieve it and just figured by just using the status quo of me randomly living frugal and saving money by chance I would hit that mark.

Well today I’m going to actually look do the math and see where that status quo puts me and see what it will take for me to hit $1M by age 40.

Scenario 1 – Do nothing and let the market do the work for me.

I very recently had my retirement nest egg cross the the $600,000 mark and I have 3 years until my 40th birthday. In my last annual report I decided to include another $60,000 of private stock I own. If I were to never put another penny into the market I would need to have annualized returns of 14.86% over the next three years for my accounts to hit $1,000,000.

Odds of Success: 10%

Commentary: This would be a rather poor approach as it relies 100% on things out of my control and would rely on very unrealistic and uncharacteristic returns by the market as a whole or me to do something even more stupid and take on a idiotic amount of risk that would likely result in me putting together a new $100,000 by Age 45 post than it would welcoming me into the double comma club.

Scenario 2 – Average market returns – plus ho hum contributions.

If I expected annual returns of 10% I would need to contribute $38,000 to my retirement each of the next 3 years in order to hit the $1 million dollar mark.

Odds of Success: 40%

Commentary: The first problem with this plan is that it requires 10% annualized returns – which while that is historically an average return, the market is anything but a constant and almost never returns anything near 10% for a single year and is often much higher or lower than that.

Scenario 3 – Continue contributing as planned and hope for strong market returns

I currently have budgeted that I will contribute about 50k a year to our retirement accounts. I feel like this is very doable going forward as my 401k and employer matching account for about $29,000 per year. If I max out mine and my wife’s Roth IRAs that is another $11k and then I need to put $10k into a taxable account that will help the transition into early retirement by giving me an account with less strings attached to the money. If I were to do this I would need to achieve about 8.73% annualized returns from my investments.

Odds of Success: 60%

Commentary: I feel like this is probably the most well balanced plan. It is also ironically the path forward that I was already taking, but it gives me a little assurance that the math kind of works out.

The big question mark is what the market will do the next three years – which as anyone with any sense will tell you is that they have absolutely no idea. The market could be down all three years or it could be up significantly. Historical market average is around 10%, but almost never during a 1 year period will the average return be anywhere close to that and it doesn’t get a whole lot better in a short period of time like three years.

Ultimately this is the reason my $100,000 by 30 goal was all about contributions as it was entirely in my control, but that ship has sailed and going forward the whims of the market will be what is controlling my ship versus what I am doing.

The other item to factor in is my ability to put way $50k per year into my retirement accounts. The last two years I averaged $45k and while I’m already close to $60k this year that included a $25,000 boost from my cash savings that was a one time thing.

It certainly is possible for me to save that much money but we currently built some extravagant mansion out in the country with a $300,000 mortgage, have 5 kids, and a million home improvement projects lined up for the house so it may come down to a choice of spending like drunken sailors or hitting the $1M mark or finding ways to bring in additional income.

One wildcard with this scenario is that my wife does not currently have an income producing job as she is raising our five kids could theoretically land a teaching job in the next year or two or come up with other ways to make money which would definitely help on the income part and increase our odds.

Conclusion

It appears I am definitely on the right path and I have a couple of plausible scenarios to get me to my goal. I obviously will be targeting Scenario #3 which has the highest odds of success, but it is also apparent to me that this goal is very much out of my hands at this point. It reinforces that the real power to have drastic affect on your future wealth is achieved at a young age many years in the past. This sets the foundation and you are able to just plow through the choppy market waters and keep moving forward.

Once enough time has passed and your nest egg has grown to sufficient size you are a captain on a large ship with a tiny rudder and you are able to make less of an impact than you could 5 or 10 years ago. The only caveat to that statement is that your rudder right now is much larger than it will be 5 to 10 years down the road so while your saving habits certainly have less affect overall than they did in the past they certainly have much more than they will down the road. Which is fine because hopefully at that point I am just on the ship enjoying the view.