Waiting Just One More Year To Start Investing

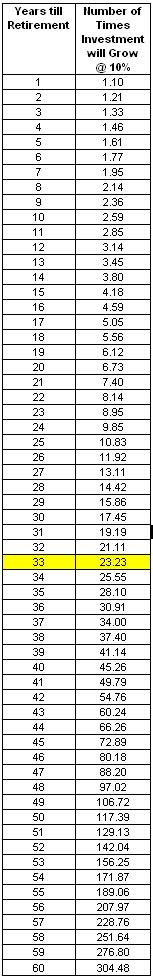

How many years do you have till retirement? Thinking about putting off saving for retirement just one more year? Well check out the chart below to see what it will cost you.

In my case I am 26.5 years old and the earliest I can withdraw any money from my retirement accounts is when I am 59.5, so I have 33 years till retirement. If I look at my chart it says that every dollar I invest this year will be worth 23.23 times that when I turn 59.5 (assuming I get 10% annualized growth). So if I invest $1000 this year, it would be worth $23,230 when I retire…..$10,000 invested now would be worth $232,300….you get the idea. Well lets say I decide to hold onto my $10,000 just one more year now that money will only have 32 years to grow and would only be worth $211,100. So I would essentially lose over $21,000 at retirement just by putting it off 1 year.

Now if just for fun I go back and think if I could have just scrounged up some money from my summer job in high school when I was 16 years old (44 years till retirement) that money would have grown 66.26 times by the time I wanted to use it at retirement. It really is amazing to see the power of compounding available to someone who has 40 or 50 years a head of them. I think about my new born son and realize that with 60 years till his retirement if somehow I could put $10,000 away for him in some trust for his retirement I could give him over $3 million dollars at retirement, with just that $10k.

Compound interest truly is a powerful thing, but if you look at the top part of the chart you’ll notice that it isn’t all that powerful, in fact the contributions that you make in the last 20 years before your retirement really don’t do much for you. That’s why I want to try to invest as much as I can while the power is on my side and once I get in my 40s I hope to be primarily done saving for my retirement.

[Tags]Investing, Retirement, Saving[/Tags]